Dec 22, 2007

Market has been quiet in the last two weeks – not much trading from India with USA & Europe but steady business with other markets. Prices have come down few cents from the peaks of November. Levels traded W240 around 2.95, W320 around 2.60, W450 around 2.50 FOB

USA & Europe are showing interest at the lower levels – Indian packers are not keen to sell at these levels but there are reports of some sales from Vietnam for Apr forwards..

No fresh news from Brazil – jury is still out on the size of the crop… if it is as small as some people say, availability from Brazil in 2008 will be much lower than last few years

Rawcashew prices are steady – Tanzania around 1050-1075, Mozambique around 850 C&F. It seems availability from these two origins will be more or less the same as last year but prices are substantially higher & with increased processing costs, the parity is higher than current kernel prices

Going into 2008, the cashew market is at a crossroad. If the NEED of USA & Europe buyers to cover in Jan/Feb is high (like it was in Nov) then prices will move up again and timing will be very wrong. RCN prices in second quarter – when over 70% of the world crop is traded – will be high. If processors are forced to buy RCN at high prices, it will set the floor for kernel prices for Apr/May forwards - it will be interesting to see what impact it will have on buying for second half of the year. On the other hand, if buyers do not NEED to buy too much in the first quarter, prices will remain in a reasonable range and there may not be much movement

First few weeks of 2008 are going to be unusually crucial & critical – volume of activity in this period will have great impact on price (and demand) trend and consequently the fortunes of the cashew sector for rest of the year

Would appreciate your comments on market situation, consumption trends, forecast of demand and market trend.... and any other info / news

Regards

Pankaj N. Sampat

Mumbai India

Monday, December 24, 2007

Israel seeks US help to fight Iranian pistachios

Posted Thu Nov 22, 2007 11:50am AEDT

A US official says Israel has asked for US help in cracking down on illegal pistachio nut imports from Iran, after Washington warned the trade was hurting efforts to curb Tehran's nuclear programme.

Israel imports pistachios worth 100 million shekels ($29.8 million) annually, mostly from Turkey.

But Washington says nuts from arch-foe Iran are mixed in with the shipments, undermining economic sanctions meant to force Tehran to stop developing its nuclear capabilities.

US Under Secretary of Agriculture Mark Keenum urged Israeli Agriculture Minister Shalom Simhon this week to combat the problem. Mr Simhon agreed, but asked for guidance on how Israel might proceed.

"Israel doesn't have to be urged too much to do something that will deny Iran trade dollars," said Zvi Alon, an official in Israel's Agriculture Ministry.

A US official says Israel has asked for US help in cracking down on illegal pistachio nut imports from Iran, after Washington warned the trade was hurting efforts to curb Tehran's nuclear programme.

Israel imports pistachios worth 100 million shekels ($29.8 million) annually, mostly from Turkey.

But Washington says nuts from arch-foe Iran are mixed in with the shipments, undermining economic sanctions meant to force Tehran to stop developing its nuclear capabilities.

US Under Secretary of Agriculture Mark Keenum urged Israeli Agriculture Minister Shalom Simhon this week to combat the problem. Mr Simhon agreed, but asked for guidance on how Israel might proceed.

"Israel doesn't have to be urged too much to do something that will deny Iran trade dollars," said Zvi Alon, an official in Israel's Agriculture Ministry.

Thursday, December 13, 2007

Is She A Nut ? Please Comment

Please Comment and tell me What you think ? the funniest comment gets 5 free pound of pistachio nuts

Tuesday, December 11, 2007

India, Brazil, Vietnam launch cashew alliance

newsIndia, Brazil and Vietnam, the three main cashew producers, have formed a global alliance for cashew with a view to protecting their interests, union minister of state for commerce Jairam Ramesh said. The grouping would have its headquarters in India and the government is debating the feasibility of locating it at Kochi, Kollam, Bangalore or Mumbai amidst pressures for locating it at Kollam, the minister said at a press meet.Unlike the OPEC, the minister said, the cashew alliance would work as a lose confederation of three major cashew producers of the world, aiming to ensure that interests of the three countries do not get hurt. India, which produces and imports half a million tonnes of cashew annually, is the world's largest cashew producer, importer, processor and consumer. The alliance will ensure that high productivity in a country will not have destabilising effect in the other two countries, he said. The concept was ready and the three countries have agreed for such an alliance. In the next six months, a decision in this regard is likely to be taken, he said. On the proposal for setting up a cashew board, the minister said the Indian Institute of Foreign Trade had been asked to carry out a study on the best way to organise the cashew industry in India.A global alliance for promotion of cashew had already come into force with two of the three major cashew producing and exporting countries as India and Vietnam and signing an agreement in this regard in January. Besides ensuring price stability, Brazil, India and Vietnam will work jointly and through their governments to induce international organisations like FAO, UNIDO and other similar agencies to focus on cashews with the objective of increasing consumption of cashews in all countries as a food of importance.These countries intend to work towards promotion of cashews in new and expanding areas of indirect consumption such as chocolate, confectionery and bakery products, and as food ingredients. Apart from promoting the commodity, these countries want to work in a spirit of cooperation for research and development, primarily for studies in nutritional and health benefits and product development.The alliance also plans to enlist the support of the International Nuts and Dried Fruits Council, which is specialised in the promotion of treenuts and dried fruits.The three countries would also regularly exchange information on crop prospects; production, import and export figures; reliable market information; and government policies affecting the industry. Source: domain-b.com

newsIndia, Brazil and Vietnam, the three main cashew producers, have formed a global alliance for cashew with a view to protecting their interests, union minister of state for commerce Jairam Ramesh said. The grouping would have its headquarters in India and the government is debating the feasibility of locating it at Kochi, Kollam, Bangalore or Mumbai amidst pressures for locating it at Kollam, the minister said at a press meet.Unlike the OPEC, the minister said, the cashew alliance would work as a lose confederation of three major cashew producers of the world, aiming to ensure that interests of the three countries do not get hurt. India, which produces and imports half a million tonnes of cashew annually, is the world's largest cashew producer, importer, processor and consumer. The alliance will ensure that high productivity in a country will not have destabilising effect in the other two countries, he said. The concept was ready and the three countries have agreed for such an alliance. In the next six months, a decision in this regard is likely to be taken, he said. On the proposal for setting up a cashew board, the minister said the Indian Institute of Foreign Trade had been asked to carry out a study on the best way to organise the cashew industry in India.A global alliance for promotion of cashew had already come into force with two of the three major cashew producing and exporting countries as India and Vietnam and signing an agreement in this regard in January. Besides ensuring price stability, Brazil, India and Vietnam will work jointly and through their governments to induce international organisations like FAO, UNIDO and other similar agencies to focus on cashews with the objective of increasing consumption of cashews in all countries as a food of importance.These countries intend to work towards promotion of cashews in new and expanding areas of indirect consumption such as chocolate, confectionery and bakery products, and as food ingredients. Apart from promoting the commodity, these countries want to work in a spirit of cooperation for research and development, primarily for studies in nutritional and health benefits and product development.The alliance also plans to enlist the support of the International Nuts and Dried Fruits Council, which is specialised in the promotion of treenuts and dried fruits.The three countries would also regularly exchange information on crop prospects; production, import and export figures; reliable market information; and government policies affecting the industry. Source: domain-b.com

UNNATI GANDHI

From Friday's Globe and Mail

December 7, 2007 at 4:52 AM EST

A cocktail of poor weather conditions, health-conscious consumers and the generous use of cranberries in everything from trail mixes to lotions has led to an industry-wide shortage of the tart red fruit this year, production and retail officials say.

And the timing couldn't have been worse, with the annual cranberry binge set to begin with the holiday season.

Blake Johnston, president of Canada's largest cranberry packing company, Bezanson & Chase of Aylesford, N.S., said he has produced 50 per cent fewer cranberries this season than expected.

"I'm short two million pounds of fresh cranberries, and that shortage started in September and continued through the season. And I've already gone through about two million pounds this year," he said in a telephone interview from Wisconsin. "I'm out here right now looking for cranberries, and there are none." Shortages tend to mean price hikes on dwindling inventories.

Prices have gone up by as much as 20 per cent in some markets this year, according to Jean-François Bieler of Atoka Cranberries in Manseau, Que.

According to data from the Cranberry Marketing Company, a U.S. industry group, the wholesale price of cranberry-juice concentrate charged by processors to juice makers and other distributors increased to $65 (U.S.) a gallon last month from $45 in August.

Mr. Bieler is one of those dried cranberry and juice concentrate processors. His company operates the largest single-site cranberry farm in the world, and exports 90 per cent of its inventory.

Mr. Bieler said that with a 15-per-cent decline in supply industry-wide since last year, and at least a 7-per-cent increase in demand, price increases this season are going to be "pretty impressive," going well beyond the average $2.99 per 12 oz. package.

In Canada, where cranberries are typically grown in Atlantic Canada and Ontario's Muskoka region, cooler and drier than normal summers in Quebec and New Brunswick this year have led to a 30-per-cent crop decline, he said.

"All I can suggest is if you see fresh cranberries in the supermarket, buy them now and put them in the freezer," Mr. Bieler said.

Tammy Smitham, spokeswoman for A&P, said there was a shortage in supplies after the U.S. Thanksgiving, but the chain is hopeful that it will have enough to last through to Christmas.

"But there won't be any especially hot advertising or promotion on it because we want to be able to ensure that we can meet demand right through," she said.

What's driving the increase in demand, which has steadily risen by 20 per cent each of the past five years in Canada and the United States, Mr. Bieler said, is the use of cranberries in everything "healthy," including cereals, granola bars and snacks.

"Whereas before it used to be just around the holidays, it's almost a staple food now. There's less and less seasonality with cranberries now."

Much of that is attributed to the marketing efforts of industry leader Ocean Spray Cranberries Inc., which has been promoting the health benefits of the fruit for several years. Included in that is research that has shown cranberry juice may prevent urinary tract infections. Several studies have found that that the fruit also has high levels of antioxidants.

"We've had wild increase in demand for our products over the past year or two ... definitely in the double digits internationally and domestically," Ocean Spray spokesman Chris Phillips said.

Marc Stevens

From Friday's Globe and Mail

December 7, 2007 at 4:52 AM EST

A cocktail of poor weather conditions, health-conscious consumers and the generous use of cranberries in everything from trail mixes to lotions has led to an industry-wide shortage of the tart red fruit this year, production and retail officials say.

And the timing couldn't have been worse, with the annual cranberry binge set to begin with the holiday season.

Blake Johnston, president of Canada's largest cranberry packing company, Bezanson & Chase of Aylesford, N.S., said he has produced 50 per cent fewer cranberries this season than expected.

"I'm short two million pounds of fresh cranberries, and that shortage started in September and continued through the season. And I've already gone through about two million pounds this year," he said in a telephone interview from Wisconsin. "I'm out here right now looking for cranberries, and there are none." Shortages tend to mean price hikes on dwindling inventories.

Prices have gone up by as much as 20 per cent in some markets this year, according to Jean-François Bieler of Atoka Cranberries in Manseau, Que.

According to data from the Cranberry Marketing Company, a U.S. industry group, the wholesale price of cranberry-juice concentrate charged by processors to juice makers and other distributors increased to $65 (U.S.) a gallon last month from $45 in August.

Mr. Bieler is one of those dried cranberry and juice concentrate processors. His company operates the largest single-site cranberry farm in the world, and exports 90 per cent of its inventory.

Mr. Bieler said that with a 15-per-cent decline in supply industry-wide since last year, and at least a 7-per-cent increase in demand, price increases this season are going to be "pretty impressive," going well beyond the average $2.99 per 12 oz. package.

In Canada, where cranberries are typically grown in Atlantic Canada and Ontario's Muskoka region, cooler and drier than normal summers in Quebec and New Brunswick this year have led to a 30-per-cent crop decline, he said.

"All I can suggest is if you see fresh cranberries in the supermarket, buy them now and put them in the freezer," Mr. Bieler said.

Tammy Smitham, spokeswoman for A&P, said there was a shortage in supplies after the U.S. Thanksgiving, but the chain is hopeful that it will have enough to last through to Christmas.

"But there won't be any especially hot advertising or promotion on it because we want to be able to ensure that we can meet demand right through," she said.

What's driving the increase in demand, which has steadily risen by 20 per cent each of the past five years in Canada and the United States, Mr. Bieler said, is the use of cranberries in everything "healthy," including cereals, granola bars and snacks.

"Whereas before it used to be just around the holidays, it's almost a staple food now. There's less and less seasonality with cranberries now."

Much of that is attributed to the marketing efforts of industry leader Ocean Spray Cranberries Inc., which has been promoting the health benefits of the fruit for several years. Included in that is research that has shown cranberry juice may prevent urinary tract infections. Several studies have found that that the fruit also has high levels of antioxidants.

"We've had wild increase in demand for our products over the past year or two ... definitely in the double digits internationally and domestically," Ocean Spray spokesman Chris Phillips said.

Marc Stevens

Monday, December 10, 2007

Weekly Cashews Update Dec 8, 2007

After a month of continuous rise, cashew market is taking a breather and prices dipped a bit – levels traded at the end of this week W240 around 3.00, W320 around 2.65, W450 around 2.50 FOB. There was limited activity – most of it from small & medium packers in India except for the broken grades where Vietnam was more active due to their lower prices.

Brazil continues to be quiet – in the next few weeks, there should be some selling interest from there unless the crop is very very bad. If crop is around 275,000mt as many people expect, they will have a reasonable quantity to sell for FH 2008 shipment as they do not seem to have sold much so far.

Indonesia & East Africa RCN prices did come down a bit this week following quiet kernel market but they are still at disparity considering that outturns are lower and forward kernel sales are not easy.. Processors are buying against earlier sales which were at much lower levels and they will only buy as much as they absolutely need to, unless prices ease further

If nearby short positions are covered, kernel buyers might decide to limit their buying over the next few weeks to cover gaps.. This will bring some sanity to the market but if the demand after holidays is anything like what we saw in Nov, prices may go up again in Jan/Feb.. This will mean higher RCN prices in India, Vietnam, West Africa and consequently keep kernel prices high throughout 2008

Regards

Pankaj N. Sampat

After a month of continuous rise, cashew market is taking a breather and prices dipped a bit – levels traded at the end of this week W240 around 3.00, W320 around 2.65, W450 around 2.50 FOB. There was limited activity – most of it from small & medium packers in India except for the broken grades where Vietnam was more active due to their lower prices.

Brazil continues to be quiet – in the next few weeks, there should be some selling interest from there unless the crop is very very bad. If crop is around 275,000mt as many people expect, they will have a reasonable quantity to sell for FH 2008 shipment as they do not seem to have sold much so far.

Indonesia & East Africa RCN prices did come down a bit this week following quiet kernel market but they are still at disparity considering that outturns are lower and forward kernel sales are not easy.. Processors are buying against earlier sales which were at much lower levels and they will only buy as much as they absolutely need to, unless prices ease further

If nearby short positions are covered, kernel buyers might decide to limit their buying over the next few weeks to cover gaps.. This will bring some sanity to the market but if the demand after holidays is anything like what we saw in Nov, prices may go up again in Jan/Feb.. This will mean higher RCN prices in India, Vietnam, West Africa and consequently keep kernel prices high throughout 2008

Regards

Pankaj N. Sampat

Wednesday, November 21, 2007

US asks Israel to stop importing pistachio from Iran

Washington displeased with nuts smuggled to Turkey from Tehran and imported to Jewish state

Itamar Eichner

Published:

US Undersecretary of Agriculture Mark Keenum demanded Monday that the Israeli import from Turkey of pistachio nuts originating in Iran be halted immediately, Yedioth Ahronoth has learned.

The US undersecretary met with Israeli Agriculture Minister Shalom Simhon in Rome during a conference organized by the International Food and Agricultural Organization.

Bill:

'No economic ties between Israel, Iran' / Tzvi Lavi

Opposition Chairman Netanyahu presents Knesset with legislative initiative prohibiting Israeli institutional bodies from investing in companies that have business ties with Iran

Full story

The Israeli embassy in Italy reported to the Foreign Ministry in Jerusalem that the Americans are working to stop the export of Iranian pistachio nuts as part of the economic sanctions imposed on the Islamic republic.

Keenum told Simhon that it was absurd that Israel was purchasing most of its pistachio nuts from an enemy state. According to the undersecretary, Washington was extremely troubled by this, as US pistachio growers have protested the fact that America's friend favors Iranian pistachio nuts over American ones.

Simhon, who was surprised by the information, promised to act immediately to halt the import of the forbidden pistachio nuts. "Israel is not interested in helping Iran's economy," he said.

Iran is the world's biggest exporter of pistachio nuts, while Israel is the world's biggest importer of pistachio.

"We all know what the Israelis like to do on Friday night in front of their television sets," said Zvi Alon, senior deputy-director general (foreign trade) of the Ministry of Agriculture and Rural Development. "The Israelis just love their pistachio nuts."

Monday, November 19, 2007

Weekly cashews Update

Nov 17, 2007

The climb continues… during this week, price for benchmark W320 grade moved up more than 4% - 10 cents a lb. Other grades also moved up by around 5 cents. Business was done from India & Vietnam for W240 around 2.90, W320 around 2.55, W450 around 2.40 FOB. There are reports of sales few cents higher as well. USA was the most active buyer but other markets also participated to some extent

Brazil is still not offering any significant quantities – in addition to the effects of the strong Real, processors are probably concerned about size of the crop following the delay in arrivals in the main growing areas

Cashew Board of Tanzania announced daily auctions in different areas but like the procurement policy, the auction rules also are unworkable. Due to the limited availability of RCN, prices for the only available origin – Indonesia – have gone up to a level that is unworkable even at the increased kernel prices

One significant factor of the last three weeks has been that although market has gone up 10%, the volume traded has been small. We can see two reasons for this limited volume (1) most processors have adequate sales for next few months and in a sharply rising market, they are reluctant to sell large quantities – more so, due to uncertainty of RCN pricing and weak USD (2) although there has been some buying by roasters, most of the buying has been short covering by importers who were waiting for Brazil & Tanzania crops to cover Oct-Mar requirements but are now forced to chase limited quantities. Delays from some suppliers in India & Vietnam have added to the quantities they need to buy. But, they are buying only what they absolutely need to fulfill delivery commitments

Buyers are not willing to buy any large quantities for forwards at higher levels as they are not sure these levels can be sustained when Northern Hemisphere crops start in March.. Although there is a temporary squeeze in supplies there is no significant change in overall availability.. Current price rise seems to be combination of this temporary squeeze + precautionary buying + shipment delays

As we said in our previous reports, if the market strength continues in the first quarter of 2008 it will lead to higher RCN prices in second quarter which will mean that processors will have to sell in 2008 at prices substantially higher than what we have been used to in the last couple of years

The weak USD will certainly soften the blow for the roasters & retailers in non-US markets (in some cases there will be hardly any change in price) but the adverse impact on rawmaterial & processing costs in origins is quite significant

In any commodity, a sudden change in prices – up or down – has more adverse & less beneficial impact. Sudden moves – without significant change in fundamentals - give misleading signals to people who do not look at the wider picture & their reactions distort operations for all stakeholders in the chain which is not good for the growth and health of the business

We can expect uncertainty – and scarcity of offers - to continue for a few weeks and this should give everyone time to reflect on how they should react to the current situation

Would appreciate your views on present market situation, your forecast on activity & price trend for next 2-3 months and your insight on movements on demand side for 2008

Regards

Pankaj N. Sampat

Nov 17, 2007

The climb continues… during this week, price for benchmark W320 grade moved up more than 4% - 10 cents a lb. Other grades also moved up by around 5 cents. Business was done from India & Vietnam for W240 around 2.90, W320 around 2.55, W450 around 2.40 FOB. There are reports of sales few cents higher as well. USA was the most active buyer but other markets also participated to some extent

Brazil is still not offering any significant quantities – in addition to the effects of the strong Real, processors are probably concerned about size of the crop following the delay in arrivals in the main growing areas

Cashew Board of Tanzania announced daily auctions in different areas but like the procurement policy, the auction rules also are unworkable. Due to the limited availability of RCN, prices for the only available origin – Indonesia – have gone up to a level that is unworkable even at the increased kernel prices

One significant factor of the last three weeks has been that although market has gone up 10%, the volume traded has been small. We can see two reasons for this limited volume (1) most processors have adequate sales for next few months and in a sharply rising market, they are reluctant to sell large quantities – more so, due to uncertainty of RCN pricing and weak USD (2) although there has been some buying by roasters, most of the buying has been short covering by importers who were waiting for Brazil & Tanzania crops to cover Oct-Mar requirements but are now forced to chase limited quantities. Delays from some suppliers in India & Vietnam have added to the quantities they need to buy. But, they are buying only what they absolutely need to fulfill delivery commitments

Buyers are not willing to buy any large quantities for forwards at higher levels as they are not sure these levels can be sustained when Northern Hemisphere crops start in March.. Although there is a temporary squeeze in supplies there is no significant change in overall availability.. Current price rise seems to be combination of this temporary squeeze + precautionary buying + shipment delays

As we said in our previous reports, if the market strength continues in the first quarter of 2008 it will lead to higher RCN prices in second quarter which will mean that processors will have to sell in 2008 at prices substantially higher than what we have been used to in the last couple of years

The weak USD will certainly soften the blow for the roasters & retailers in non-US markets (in some cases there will be hardly any change in price) but the adverse impact on rawmaterial & processing costs in origins is quite significant

In any commodity, a sudden change in prices – up or down – has more adverse & less beneficial impact. Sudden moves – without significant change in fundamentals - give misleading signals to people who do not look at the wider picture & their reactions distort operations for all stakeholders in the chain which is not good for the growth and health of the business

We can expect uncertainty – and scarcity of offers - to continue for a few weeks and this should give everyone time to reflect on how they should react to the current situation

Would appreciate your views on present market situation, your forecast on activity & price trend for next 2-3 months and your insight on movements on demand side for 2008

Regards

Pankaj N. Sampat

Monday, November 12, 2007

Our weekly cashews update

Nov 12, 2007

Cashew market continued its upward movement last week - business was done W240 around 2.85, W320 around 2.45, W450 around 2.30 FOB. There were rumours of some trades for W320 few cents higher as well. There was a fair amount of buying interest from USA at these levels and other markets are also picking up some quantities. Offers from India and Vietnam are limited - processors are concerned how things will move in coming weeks after the big jump on small volume. Processors in Brazil are still not offering any significant quantities... and this situation will continue until RCN arrivals pick upTanzania RCN has still not started moving. Until the stalemate is resolved, Indian processors will be reluctant to make any large sales for 2008 shipments as they do not know what price they will have to pay for seed for first quarter processing. If buying interest does not subside in coming weeks, we could be looking at firmer market throughout 2008 but on the other hand, if buyers keep away from the market for few weeks till East Africa & Brazil crops start moving we will see the market stabilising around current levels.. After that, next direction - up or down - will depend on how kernel buyers operate in first quarter (just before Vietnam, India, West Africa crops start)

Regards,

Pankaj N. Sampat

Mumbai India

Nov 12, 2007

Cashew market continued its upward movement last week - business was done W240 around 2.85, W320 around 2.45, W450 around 2.30 FOB. There were rumours of some trades for W320 few cents higher as well. There was a fair amount of buying interest from USA at these levels and other markets are also picking up some quantities. Offers from India and Vietnam are limited - processors are concerned how things will move in coming weeks after the big jump on small volume. Processors in Brazil are still not offering any significant quantities... and this situation will continue until RCN arrivals pick upTanzania RCN has still not started moving. Until the stalemate is resolved, Indian processors will be reluctant to make any large sales for 2008 shipments as they do not know what price they will have to pay for seed for first quarter processing. If buying interest does not subside in coming weeks, we could be looking at firmer market throughout 2008 but on the other hand, if buyers keep away from the market for few weeks till East Africa & Brazil crops start moving we will see the market stabilising around current levels.. After that, next direction - up or down - will depend on how kernel buyers operate in first quarter (just before Vietnam, India, West Africa crops start)

Regards,

Pankaj N. Sampat

Mumbai India

Monday, November 05, 2007

: "A shortage is expected"First Diamond walnuts arrived in EuropeTholen - This morning, the first boat with new Diamond walnuts has arrived in Europe. A shortage of several nuts and dried fruits including Diamond walnuts is expected. The first boat - of course - also carried walnuts for the Dutch importer Tovano. Richard Strijbis of Tovano was very pleased with the quality of the first Diamond walnuts. In spite of the shortage, Tovano will regularly receive Diamond walnuts. “We recommend our customers to reserve the volume they want to buy in advance”, says Richard Strijbis.

look at these articles basically they are preparing us for the surge in price

US: Cranberry production surges on wave of demand

With candy-corn season past, the holiday feast season has begun, and that calls for a lot of cranberries.Washington produces many of its own cranberries in the state's southwest corner, where farmers expect this year's harvest to yield 180,000 barrels, or about 18 million pounds. It is the country's fifth-largest cranberry producer.Some will be sold fresh and used in cranberry sauce, but most become cranberry juice or dried, sweetened cranberries.This year, dried cranberries surpassed dried apricots as the country's second-most-popular dried fruit. They still trail raisins, which have more than 40 percent of the market, according to Grocery Headquarters Magazine.Part of cranberries' popularity comes from their recently discovered antioxidant value. By some measures, cranberries have more antioxidants than blueberries, a claim that ticks off some blueberry producers."Cranberries are upsetting some other berries, that's for sure," said Peter Guyer, president of Athena Marketing International in Seattle, a consulting firm for the food and beverage industry. Some players, even in the cranberry industry, want a standard measure for antioxidants so that consumers will know which claims to trust, Guyer said.Ocean Spray recently spent almost $18 million boosting production of its "Craisins" at a factory in Markham, near Aberdeen.More than half of Washington's cranberries become Craisins, estimated Kim Patten, a horticulture professor at Washington State University's extension unit on the Long Beach Peninsula.Still, during last week's sunny weather, Washington cranberry farmers harvested as many fresh cranberries as they could. Fresh cranberries bring prices 20 to 40 percent higher than those sold for processing, said Carl Waara, a fourth-generation cranberry farmer in Grayland.With vines dating back to 1925, Waara remains one of the state's few full-time cranberry farmers.Many were wiped out in a market crash about a decade ago. Others suffered from last year's anemic harvest, which came in about 39 percent below the prior year."Last year was the worst in history, for me personally and for most of the area," Waara said. His cranberries rebounded along with most of the state's crop this year.Source: theolympian.com

US: Cranberry production surges on wave of demand

With candy-corn season past, the holiday feast season has begun, and that calls for a lot of cranberries.Washington produces many of its own cranberries in the state's southwest corner, where farmers expect this year's harvest to yield 180,000 barrels, or about 18 million pounds. It is the country's fifth-largest cranberry producer.Some will be sold fresh and used in cranberry sauce, but most become cranberry juice or dried, sweetened cranberries.This year, dried cranberries surpassed dried apricots as the country's second-most-popular dried fruit. They still trail raisins, which have more than 40 percent of the market, according to Grocery Headquarters Magazine.Part of cranberries' popularity comes from their recently discovered antioxidant value. By some measures, cranberries have more antioxidants than blueberries, a claim that ticks off some blueberry producers."Cranberries are upsetting some other berries, that's for sure," said Peter Guyer, president of Athena Marketing International in Seattle, a consulting firm for the food and beverage industry. Some players, even in the cranberry industry, want a standard measure for antioxidants so that consumers will know which claims to trust, Guyer said.Ocean Spray recently spent almost $18 million boosting production of its "Craisins" at a factory in Markham, near Aberdeen.More than half of Washington's cranberries become Craisins, estimated Kim Patten, a horticulture professor at Washington State University's extension unit on the Long Beach Peninsula.Still, during last week's sunny weather, Washington cranberry farmers harvested as many fresh cranberries as they could. Fresh cranberries bring prices 20 to 40 percent higher than those sold for processing, said Carl Waara, a fourth-generation cranberry farmer in Grayland.With vines dating back to 1925, Waara remains one of the state's few full-time cranberry farmers.Many were wiped out in a market crash about a decade ago. Others suffered from last year's anemic harvest, which came in about 39 percent below the prior year."Last year was the worst in history, for me personally and for most of the area," Waara said. His cranberries rebounded along with most of the state's crop this year.Source: theolympian.com

Sunday, November 04, 2007

Pecan Market Update

Oct,4 2007

New crop pricing are starting to come in and everyone is looking for the lowest prices that will become available.

starting prices are opening @ $3.85 FOB TX for Jr. Mammoth halves with all the hopes that from here we will see this market declining which some even think it could come down as low as $3.50 lb.

hopefully we should know more in the next 2 weeks.

Oct,4 2007

New crop pricing are starting to come in and everyone is looking for the lowest prices that will become available.

starting prices are opening @ $3.85 FOB TX for Jr. Mammoth halves with all the hopes that from here we will see this market declining which some even think it could come down as low as $3.50 lb.

hopefully we should know more in the next 2 weeks.

Weekly Cashews Market Update

Nov 3, 2007

Cashew prices moved up again middle of this week – volume traded was limited due to reluctance of processors. Business was done W240 at 2.70/72, W320 at 2.35/37 and W450 at 2.20/22 FOB (there are rumours of some sales few cents higher as well). Most of the business was for nearbys but there were reports of some sales for forwards as well.

Vietnam is reported to have sold reasonable quantities in last two weeks, and they seem to be willing to sell few cents lower than India for 2008 shipments. Brazil is relatively quiet and this was probably the trigger for firming up of market at this time – buyers who were waiting & hoping to cover Nov-Mar shipments from Brazil are now buying from other origins due to lack of any big selling interest from Brazil. Unless Brazil is able to offer reasonable quantities in coming weeks, firmness will continue

Tanzania RCN has still not started moving. Until the stalemate is resolved, Indian processors will be reluctant to make any large sales for 2008 shipments as they do not know what price they will have to pay for seed for first quarter processing. And this will have impact on RCN pricing at the beginning of India, Vietnam, West Africa as well

Market is currently influenced by unusual tightness in supply of RCN (normally at this time Tanzania & Brazil crops should be in full swing). If buyers continue to buy aggressively in coming weeks, we might see a new higher range being established for 2008. But if they slow down after covering immediate needs, we will see prices stabilising around current levels for next few months. Next indicator for price trend for second half 2008 will be the Northern Hemisphere crops beginning in March

Market is very delicately poised and so, a time to be careful

>>>

Would appreciate your views on current market situation, forecast for demand and price trends in 2008 and any other news or info

Mumbai India

Nov 3, 2007

Cashew prices moved up again middle of this week – volume traded was limited due to reluctance of processors. Business was done W240 at 2.70/72, W320 at 2.35/37 and W450 at 2.20/22 FOB (there are rumours of some sales few cents higher as well). Most of the business was for nearbys but there were reports of some sales for forwards as well.

Vietnam is reported to have sold reasonable quantities in last two weeks, and they seem to be willing to sell few cents lower than India for 2008 shipments. Brazil is relatively quiet and this was probably the trigger for firming up of market at this time – buyers who were waiting & hoping to cover Nov-Mar shipments from Brazil are now buying from other origins due to lack of any big selling interest from Brazil. Unless Brazil is able to offer reasonable quantities in coming weeks, firmness will continue

Tanzania RCN has still not started moving. Until the stalemate is resolved, Indian processors will be reluctant to make any large sales for 2008 shipments as they do not know what price they will have to pay for seed for first quarter processing. And this will have impact on RCN pricing at the beginning of India, Vietnam, West Africa as well

Market is currently influenced by unusual tightness in supply of RCN (normally at this time Tanzania & Brazil crops should be in full swing). If buyers continue to buy aggressively in coming weeks, we might see a new higher range being established for 2008. But if they slow down after covering immediate needs, we will see prices stabilising around current levels for next few months. Next indicator for price trend for second half 2008 will be the Northern Hemisphere crops beginning in March

Market is very delicately poised and so, a time to be careful

>>>

Would appreciate your views on current market situation, forecast for demand and price trends in 2008 and any other news or info

Mumbai India

Wednesday, October 31, 2007

R.L. “Pete” Turner October 31, 2007

WALNUT MARKET/CROP REPORT

CROP:

The Walnut Marketing Board announced the September shipments at 22,594 inshell equivalent tons; about the same as last year. Inshell shipments were 6.9 million pounds, compared to 5.9 million pounds last September. Shelled shipments were 16.4 million pounds, 0.4 million pounds less than last year. Total inshell equivalent year to date shipments are 39,984 tons; 280 tons more than last year to date shipments.

It is still a little early to make a good crop prediction but most in the industry believe the crop is coming in short of the 320,000 tons official forecast. The early varieties as well as the Hartley’s seem to be coming in close to the forecast. However, packers and growers are reporting that Chandlers are coming in short of the official state forecast. Based on the current information and input from the grower/packers I would have to guess the crop is closer to 300,000 tons than the original 320,000 ton estimate.

However, the quality of the crop appears be well above average with very little insect or sunburn damage. The Chandlers have great color as well as the Serr’s, Vina’s and Hartley’s. Most are reporting that the Howard’s are darker than normal, but are above average in edible yield.

MARKET:

As expected, empty pipe lines put a heavy demand for early shipments causing the market to strengthen rapidly. The early opening on Light Halves & Pieces started out at $3.05 range and quickly jumped to $3.35. Inshell Jumbo opened at $1.20 and went to $1.35 when Diamond opened their price two days later. Shelled material took another jump when they opened LHP at $3.80. The market quickly followed.

The current market on Jumbo Hartley’s is between $1.50 and $1.55 with Chandler LHP offering at $3.90. Because of the shortage of small material, Medium and Small Pieces are trading $0.15 to $0.25 above the Halves and Pieces. Topping Pieces is well above the $4 levels.

Because of the sudden strengthen of the market; it is difficult to determine where it may go over the next several months. However, if the crop continues to come up short, I do not believe the market will weaken, in fact, it may get firmer as we get closer to the holidays.

Please let me know if you have any questions or comments.

Pete

WALNUT MARKET/CROP REPORT

CROP:

The Walnut Marketing Board announced the September shipments at 22,594 inshell equivalent tons; about the same as last year. Inshell shipments were 6.9 million pounds, compared to 5.9 million pounds last September. Shelled shipments were 16.4 million pounds, 0.4 million pounds less than last year. Total inshell equivalent year to date shipments are 39,984 tons; 280 tons more than last year to date shipments.

It is still a little early to make a good crop prediction but most in the industry believe the crop is coming in short of the 320,000 tons official forecast. The early varieties as well as the Hartley’s seem to be coming in close to the forecast. However, packers and growers are reporting that Chandlers are coming in short of the official state forecast. Based on the current information and input from the grower/packers I would have to guess the crop is closer to 300,000 tons than the original 320,000 ton estimate.

However, the quality of the crop appears be well above average with very little insect or sunburn damage. The Chandlers have great color as well as the Serr’s, Vina’s and Hartley’s. Most are reporting that the Howard’s are darker than normal, but are above average in edible yield.

MARKET:

As expected, empty pipe lines put a heavy demand for early shipments causing the market to strengthen rapidly. The early opening on Light Halves & Pieces started out at $3.05 range and quickly jumped to $3.35. Inshell Jumbo opened at $1.20 and went to $1.35 when Diamond opened their price two days later. Shelled material took another jump when they opened LHP at $3.80. The market quickly followed.

The current market on Jumbo Hartley’s is between $1.50 and $1.55 with Chandler LHP offering at $3.90. Because of the shortage of small material, Medium and Small Pieces are trading $0.15 to $0.25 above the Halves and Pieces. Topping Pieces is well above the $4 levels.

Because of the sudden strengthen of the market; it is difficult to determine where it may go over the next several months. However, if the crop continues to come up short, I do not believe the market will weaken, in fact, it may get firmer as we get closer to the holidays.

Please let me know if you have any questions or comments.

Pete

Vietnam′s cashew export increases in first 10 months

Vietnam has so far this year reaped cashew export revenues of 523 million U.S. dollars, posting a year-on-year rise of 27 percent, local newspaper Investment reported Friday. The country has exported some 130,000 tons of the nuts since the beginning of this year, up 22 percent, mainly to China, the United States, Russia, Japan and the Middle East, the paper quoted the Vietnamese Ministry of Agriculture and Rural Development as reporting.Vietnam planned to increase its cashew cultivation acreage to 450,000 hectares from 350,000 hectares in 2005, with estimated annual yield of 500,000 tons in 2010, said the ministry. Vietnam is expected to earn some 560 million dollars from exporting 140,000 tons of cashew nuts in 2007, up 10.9 percent and 10.2 percent respectively against 2006, according to the Vietnam Cashew Association. Source: people.com.cn

Publication date: 10/31/2007

Vietnam has so far this year reaped cashew export revenues of 523 million U.S. dollars, posting a year-on-year rise of 27 percent, local newspaper Investment reported Friday. The country has exported some 130,000 tons of the nuts since the beginning of this year, up 22 percent, mainly to China, the United States, Russia, Japan and the Middle East, the paper quoted the Vietnamese Ministry of Agriculture and Rural Development as reporting.Vietnam planned to increase its cashew cultivation acreage to 450,000 hectares from 350,000 hectares in 2005, with estimated annual yield of 500,000 tons in 2010, said the ministry. Vietnam is expected to earn some 560 million dollars from exporting 140,000 tons of cashew nuts in 2007, up 10.9 percent and 10.2 percent respectively against 2006, according to the Vietnam Cashew Association. Source: people.com.cn

Publication date: 10/31/2007

Monday, October 29, 2007

Breeding bolsters macadamia industry profits

New varieties emerging from the macadamia breeding program could increase profitability across the whole macadamia supply chain by 30 per cent. According to Project Leader, CSIRO’s Dr Craig Hardner, the best of the 20 new macadamias selected could produce double the yield of current commercial varieties.“Kernel quality seems to have also been improved through the breeding program and this may reduce the level of reject kernel prior to roasting,” Dr Hardner said. Former Deputy Chief of CSIRO Plant Industry and current Horticulture Australia Limited’s (HAL) Chair, Dr Nigel Steele Scott was part of the team that initiated the project in 1992 with a long-term set of breeding goals aimed at improving macadamia profitability.“It is really exciting to see how this project has developed, kept focus and is now delivering. All of us involved in this, now and in the past, can be proud that we have probably made the most significant progress in the domestication of any Australian native plant,” Dr Steele Scott said. The selected macadamias come from crosses made between macadamias from native populations in Australia and varieties from Hawaii developed from Australian seed. The wealth of macadamia’s genetic material in the Australian bush can be used to breed better commercial macadamia varieties suited to Australian conditions. Queensland Department of Primary Industries and Fisheries will now run trials of the selected macadamias in different regions to confirm the elite performers and their utility.“These trials will ensure growers get the most profitable varieties when they become commercially available in about eight years,” Dr Hardner said. Growers are enthusiastic about the selections and are hoping to get involved in the early trials.“These new varieties will help keep Australian producers competitive in export markets where we compete against countries with lower labour costs,” said Mr Kim Jones, Macadamia Industry Development Manager.This research is done by CSIRO in partnership with Queensland Department of Primary Industries and Fisheries and NSW Department of Primary Industries. The project was facilitated by HAL in partnership with the Australian Macadamia Society and was funded by the macadamia levy.Source: csiro.au

Publication date: 10/29/2007

New varieties emerging from the macadamia breeding program could increase profitability across the whole macadamia supply chain by 30 per cent. According to Project Leader, CSIRO’s Dr Craig Hardner, the best of the 20 new macadamias selected could produce double the yield of current commercial varieties.“Kernel quality seems to have also been improved through the breeding program and this may reduce the level of reject kernel prior to roasting,” Dr Hardner said. Former Deputy Chief of CSIRO Plant Industry and current Horticulture Australia Limited’s (HAL) Chair, Dr Nigel Steele Scott was part of the team that initiated the project in 1992 with a long-term set of breeding goals aimed at improving macadamia profitability.“It is really exciting to see how this project has developed, kept focus and is now delivering. All of us involved in this, now and in the past, can be proud that we have probably made the most significant progress in the domestication of any Australian native plant,” Dr Steele Scott said. The selected macadamias come from crosses made between macadamias from native populations in Australia and varieties from Hawaii developed from Australian seed. The wealth of macadamia’s genetic material in the Australian bush can be used to breed better commercial macadamia varieties suited to Australian conditions. Queensland Department of Primary Industries and Fisheries will now run trials of the selected macadamias in different regions to confirm the elite performers and their utility.“These trials will ensure growers get the most profitable varieties when they become commercially available in about eight years,” Dr Hardner said. Growers are enthusiastic about the selections and are hoping to get involved in the early trials.“These new varieties will help keep Australian producers competitive in export markets where we compete against countries with lower labour costs,” said Mr Kim Jones, Macadamia Industry Development Manager.This research is done by CSIRO in partnership with Queensland Department of Primary Industries and Fisheries and NSW Department of Primary Industries. The project was facilitated by HAL in partnership with the Australian Macadamia Society and was funded by the macadamia levy.Source: csiro.au

Publication date: 10/29/2007

Cashews Weekly update October 29, 2007

Although activity last week was limited, cashew market undertone was firm with very few offers – W240 around 2.70, W320 around 2.30, W450 around 2.15 FOB. Some business has been done for nearbys at these levels from India and Vietnam.

Brazil crop may not be as big as initially reported – it may only be same or slightly higher than last year. RCN prices are high & processors are finding it difficult to sell at current levels with a very strong currency

Rawcashew market is quiet – offers from Indonesia are very high and Tanzania stalemate continues. If not resolved quickly, this might affect processing in first quarter of 2008

In general, prices for all nuts are firm – some due to short crops and some due to good marketing. Growth in consumption is steady but not spectacular. As far as cashews are concerned, excess inventories have been used up – supply & demand seem to be well balanced.

Processors are reluctant to take large positions for 2008. If USD continues to be weak in first half 2008, this could have significant impact on WA RCN pricing. Buyers are still not prepared to pay premium for forwards as they feel that there is nothing on demand & supply front to warrant a big jump in prices

For next few weeks (maybe months), present trend of nearby activity and firmness can be expected to continue. Change in perception can only happen in Mar-May when three major regions will be harvesting. Exchange rate at that time and ability of processors & kernel traders and users to manage positions in the meantime will determine whether there will be a big change in price range

Regards,

Pankaj N. Sampat

Mumbai India

Although activity last week was limited, cashew market undertone was firm with very few offers – W240 around 2.70, W320 around 2.30, W450 around 2.15 FOB. Some business has been done for nearbys at these levels from India and Vietnam.

Brazil crop may not be as big as initially reported – it may only be same or slightly higher than last year. RCN prices are high & processors are finding it difficult to sell at current levels with a very strong currency

Rawcashew market is quiet – offers from Indonesia are very high and Tanzania stalemate continues. If not resolved quickly, this might affect processing in first quarter of 2008

In general, prices for all nuts are firm – some due to short crops and some due to good marketing. Growth in consumption is steady but not spectacular. As far as cashews are concerned, excess inventories have been used up – supply & demand seem to be well balanced.

Processors are reluctant to take large positions for 2008. If USD continues to be weak in first half 2008, this could have significant impact on WA RCN pricing. Buyers are still not prepared to pay premium for forwards as they feel that there is nothing on demand & supply front to warrant a big jump in prices

For next few weeks (maybe months), present trend of nearby activity and firmness can be expected to continue. Change in perception can only happen in Mar-May when three major regions will be harvesting. Exchange rate at that time and ability of processors & kernel traders and users to manage positions in the meantime will determine whether there will be a big change in price range

Regards,

Pankaj N. Sampat

Mumbai India

Monday, October 22, 2007

Rain complicates walnut harvest

STOCKTON October 17, 2007 4:24am

• Some nuts in the mud

• Can hinder mechanical harvesters Muddy orchards are complicating the end of harvest for a number of Central Valley walnut growers.

They had walnuts laid in rows on the ground when heavy rain fell on their orchards. Now, the farmers are scrambling to get the nuts picked up and dried before more rain falls.

Some farmers have almost completed harvest work, but others have much yet to do.

Walnuts grow throughout the Central Valley, but San Joaquin County has the most acreage and has had periodic rain.

Walnuts are harvested September through November. The nuts are removed from trees by machines that shake the nuts to the ground. They are then swept from the orchard floor by mechanical harvesters and taken to processing plants where they are dried and cleaned before being packed.

Virtually all – some 99 percent -- of U.S. walnuts are produced in California.

The California walnut industry is made up of over 5,300 walnut growers and about 55 walnut processors

Copyright Central Valley Business Times © 2007 Central Valley Business Times is an online unit of BizGnus, Inc. All rights reserved. No content may be reused without written permission.

STOCKTON October 17, 2007 4:24am

• Some nuts in the mud

• Can hinder mechanical harvesters Muddy orchards are complicating the end of harvest for a number of Central Valley walnut growers.

They had walnuts laid in rows on the ground when heavy rain fell on their orchards. Now, the farmers are scrambling to get the nuts picked up and dried before more rain falls.

Some farmers have almost completed harvest work, but others have much yet to do.

Walnuts grow throughout the Central Valley, but San Joaquin County has the most acreage and has had periodic rain.

Walnuts are harvested September through November. The nuts are removed from trees by machines that shake the nuts to the ground. They are then swept from the orchard floor by mechanical harvesters and taken to processing plants where they are dried and cleaned before being packed.

Virtually all – some 99 percent -- of U.S. walnuts are produced in California.

The California walnut industry is made up of over 5,300 walnut growers and about 55 walnut processors

Copyright Central Valley Business Times © 2007 Central Valley Business Times is an online unit of BizGnus, Inc. All rights reserved. No content may be reused without written permission.

Sunday, October 21, 2007

Cashews market updateOct 20, 2007

Cashew market seems to have settled down in a comfortable range – W240 around 2.65, W320 around 2.25, W450 around 2.10 FOB. Reasonable volumes are being traded from India & Vietnam.

Rawcashew market is quiet – offers from Indonesia are very high and Tanzania stalemate continues. Until they come to realistic levels, movements are unlikely to start.

Inventories of main grades are low in USA & Europe and this will keep market steady. Volume traded for next year has not been much – processors are not keen to sell unless they get a premium and buyers feel that there is nothing to trigger a change in the current price range. Supply growth will take care of normal consumption growth

Weaker USD means lower realisations for origins and attractive prices for non-US markets. This could have some impact on market in coming months

Overall feeling is that market will move within few cents of current range with a possibility of some increase in case of any supply disruption or big jump in demand

Would appreciate your comments on market situation and your forecast of demand & price trend and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Cashew market seems to have settled down in a comfortable range – W240 around 2.65, W320 around 2.25, W450 around 2.10 FOB. Reasonable volumes are being traded from India & Vietnam.

Rawcashew market is quiet – offers from Indonesia are very high and Tanzania stalemate continues. Until they come to realistic levels, movements are unlikely to start.

Inventories of main grades are low in USA & Europe and this will keep market steady. Volume traded for next year has not been much – processors are not keen to sell unless they get a premium and buyers feel that there is nothing to trigger a change in the current price range. Supply growth will take care of normal consumption growth

Weaker USD means lower realisations for origins and attractive prices for non-US markets. This could have some impact on market in coming months

Overall feeling is that market will move within few cents of current range with a possibility of some increase in case of any supply disruption or big jump in demand

Would appreciate your comments on market situation and your forecast of demand & price trend and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Friday, October 12, 2007

Time of the year when they start shelling Pecans

http://s2.photobucket.com/albums/y46/hinkbone/?action=view¤t=MVI_3738.flv

http://s2.photobucket.com/albums/y46/hinkbone/?action=view¤t=MVI_3738.flv

Monday, September 24, 2007

Weekly Cashews update

September 22, 2007

There was very little activity in cashew market this week and no change in prices. Stray trades reported W240 around 2.65, W320 around 2.25, W450 around 2.10, Splits around 1.80 FOB. Prices from Vietnam and Brazil were almost the same

Indonesia RCN being offered at high levels but no buying interest from main processors. Tanzania has not announced price, tax, policy – final meetings scheduled next week. Stakeholders hope they will fix realistic parameters so that movement is smooth and in time

Kernel buyers seem to be content to pick up quantities when reasonable offers are made… or paying up few cents for limited quantities they need to fill specific needs. There does not appear to be any interest to pay premium to build up long position

Similarly large processors are content to sell some quantities at each spurt and then wait for next selling opportunity – not keen to take any large positions unless they get a premium. Medium & small processors continue to sell when they need to (or are able to)

Product movement is steady and there is no excess inventory. This is good in the sense that entire chain is comfortable but any disruption in supply or jump in demand could queer the pitch

Overall we would expect market to move in 2.15-2.30 range unless something dramatic happens. Given the narrow margins, pricing RCN for first quarter 2008 processing and kernels for first half 2008 shipments is going to be a challenge

Regards,

Pankaj N. Sampat

Mumbai India

September 22, 2007

There was very little activity in cashew market this week and no change in prices. Stray trades reported W240 around 2.65, W320 around 2.25, W450 around 2.10, Splits around 1.80 FOB. Prices from Vietnam and Brazil were almost the same

Indonesia RCN being offered at high levels but no buying interest from main processors. Tanzania has not announced price, tax, policy – final meetings scheduled next week. Stakeholders hope they will fix realistic parameters so that movement is smooth and in time

Kernel buyers seem to be content to pick up quantities when reasonable offers are made… or paying up few cents for limited quantities they need to fill specific needs. There does not appear to be any interest to pay premium to build up long position

Similarly large processors are content to sell some quantities at each spurt and then wait for next selling opportunity – not keen to take any large positions unless they get a premium. Medium & small processors continue to sell when they need to (or are able to)

Product movement is steady and there is no excess inventory. This is good in the sense that entire chain is comfortable but any disruption in supply or jump in demand could queer the pitch

Overall we would expect market to move in 2.15-2.30 range unless something dramatic happens. Given the narrow margins, pricing RCN for first quarter 2008 processing and kernels for first half 2008 shipments is going to be a challenge

Regards,

Pankaj N. Sampat

Mumbai India

Monday, September 17, 2007

BY NEIL MURRAY

FOODNEWS

Friday August 31 2007

WITH just a few weeks to go before the US cranberry harvest begins, the Ocean Spray Growers Co-operative, the largest cranberry producer, has warned that supplies of raw material will be tight over the foreseeable future.

This backs up an earlier warning, at the FOODNEWS Juice Latin America conference in Sao Paulo, that a shortage was looming (FOODNEWS 18 May). The unfolding situation is being driven by a healthy escalation in sales from markets around the world, with the biggest impact from the US domestic market, as consumers increase their demand for the health benefits, taste and refreshment offered by cranberry products.

This position reflects that seen for many other fruits and nuts whose global demand is soaring, but whose supplies may sometimes fall short.

"Demand for cranberries has never been higher, driven by the growing awareness of taste and the many health benefits associated with the fruit. The success of Ocean Spray's marketing campaign in the US has created 8% base volume growth and this is being reflected elsewhere as the brand's position is being developed," said Jamie Robinson, commercial director of Ocean Spray International Services UK.

He told FOODNEWS that supply into the US market grew to 7.9 million barrels in 2006, compared with 7.2 million barrels in the previous year. US production is estimated at around 6.8 million barrels, and the rest of the supply is mostly accounted for by imports from Chile.

Fruit damage

Ocean Spray will not be drawn yet on prospects for the 2007 crop, but warns that recent hailstorms have definitely damaged the fruit."So there is only a slim chance for a large crop," warned Robinson. In addition, last year's crop was a record, and the natural crop cycle means that this year's harvest is bound to be smaller.

The rising popularity of Ocean Spray's 'craisins', sweetened dried cranberries (or SDCs), means that an increasing volume of cranberries is also being used for dried fruit production rather than juice and juice drinks.

Originally, cranberries were almost all processed into sauce and eaten by Americans on Thanksgiving Day. Now, more than 90% of the fruit is processed into juice, and in the next few years the market will be split between juice and SDCs."The demand is for craisins, and it is constraining the supply for juice," confirmed Robinson. A buyer in the UK confirmed that more fruit has been going for SDCs.

The fresh market takes about 5% of the fruit supply, and is relatively stable.

US cranberry sales in the September 2006-April 2007 period (the most recent for which figures are available) have risen to 4.4 million barrels, compared with 3.7 million barrels for the same period a year previously.

European demand in the year to April 2007 has, on the other hand, been relatively flat, but is now growing, especially in France. Again, the perceived health benefits of cranberries are responsible for this.

Ocean Spray will not be drawn on the cost of new crop cranberry concentrate. The present spot market price is around US$50/gallon, roughly equivalent to US$10 500/ tonne. Earlier this year, the spot price was nearer US$42/gallon.

"The price to manufacturers will go up; no question," warned Robinson.

He added: "Despite this shortage, we want to reassure our customers that the Ocean Spray Growers are committed to providing Ocean Spray supplied products for the UK.

We are, however, competing with other markets and customers to secure continuous supply."

© 2007 Agra Informa Ltd.The content of this web site is copyright by Agra Informa Ltd. Reproduction, retrieval, copying or transmission of the content of this site is not permitted without the publisher's prior consent.

FOODNEWS

Friday August 31 2007

WITH just a few weeks to go before the US cranberry harvest begins, the Ocean Spray Growers Co-operative, the largest cranberry producer, has warned that supplies of raw material will be tight over the foreseeable future.

This backs up an earlier warning, at the FOODNEWS Juice Latin America conference in Sao Paulo, that a shortage was looming (FOODNEWS 18 May). The unfolding situation is being driven by a healthy escalation in sales from markets around the world, with the biggest impact from the US domestic market, as consumers increase their demand for the health benefits, taste and refreshment offered by cranberry products.

This position reflects that seen for many other fruits and nuts whose global demand is soaring, but whose supplies may sometimes fall short.

"Demand for cranberries has never been higher, driven by the growing awareness of taste and the many health benefits associated with the fruit. The success of Ocean Spray's marketing campaign in the US has created 8% base volume growth and this is being reflected elsewhere as the brand's position is being developed," said Jamie Robinson, commercial director of Ocean Spray International Services UK.

He told FOODNEWS that supply into the US market grew to 7.9 million barrels in 2006, compared with 7.2 million barrels in the previous year. US production is estimated at around 6.8 million barrels, and the rest of the supply is mostly accounted for by imports from Chile.

Fruit damage

Ocean Spray will not be drawn yet on prospects for the 2007 crop, but warns that recent hailstorms have definitely damaged the fruit."So there is only a slim chance for a large crop," warned Robinson. In addition, last year's crop was a record, and the natural crop cycle means that this year's harvest is bound to be smaller.

The rising popularity of Ocean Spray's 'craisins', sweetened dried cranberries (or SDCs), means that an increasing volume of cranberries is also being used for dried fruit production rather than juice and juice drinks.

Originally, cranberries were almost all processed into sauce and eaten by Americans on Thanksgiving Day. Now, more than 90% of the fruit is processed into juice, and in the next few years the market will be split between juice and SDCs."The demand is for craisins, and it is constraining the supply for juice," confirmed Robinson. A buyer in the UK confirmed that more fruit has been going for SDCs.

The fresh market takes about 5% of the fruit supply, and is relatively stable.

US cranberry sales in the September 2006-April 2007 period (the most recent for which figures are available) have risen to 4.4 million barrels, compared with 3.7 million barrels for the same period a year previously.

European demand in the year to April 2007 has, on the other hand, been relatively flat, but is now growing, especially in France. Again, the perceived health benefits of cranberries are responsible for this.

Ocean Spray will not be drawn on the cost of new crop cranberry concentrate. The present spot market price is around US$50/gallon, roughly equivalent to US$10 500/ tonne. Earlier this year, the spot price was nearer US$42/gallon.

"The price to manufacturers will go up; no question," warned Robinson.

He added: "Despite this shortage, we want to reassure our customers that the Ocean Spray Growers are committed to providing Ocean Spray supplied products for the UK.

We are, however, competing with other markets and customers to secure continuous supply."

© 2007 Agra Informa Ltd.The content of this web site is copyright by Agra Informa Ltd. Reproduction, retrieval, copying or transmission of the content of this site is not permitted without the publisher's prior consent.

Weekly Cashew Update

Sep 15, 2007

Cashew market continued to be quiet – last week there were some sales of W320 from India at lower levels but this week not much activity reported. Prices are steady – around 2.65 for W240, around 2.25 for W320, around 2.15 for W450.. There were reports of sales from Vietnam at lower levels – mainly for FH 2008 shipments but some for end 2007 as well

RCN prices in Indonesia are high for early shipments but doubt whether these are sustainable with current kernel prices.. No news from Tanzania about Government / Board policy on pricing, levies, taxes - it seems crop will be normal

Brazil is expecting a good crop but this has still not resulted in any selling pressure - clearer picture should be available by mid Oct when arrivals are in full swing

In next few weeks, there might be some good demand for spot / nearby shipments but not certain whether this will translate into contracting for next year at higher levels.. Traders may decide to buy only what they absolutely need to fulfill delivery commitments and wait for dips in market to cover forward positions.

Overall demand growth seems to be steady… unless there is big jump in demand or shortage in supply (either of which could lead to change in sentiment) we expect market to stabilise around current levels with usual periodic spurts and dips

Would appreciate comments on market situation, any info on demand trends & your views on demand prospects, prices in your market and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Sep 15, 2007

Cashew market continued to be quiet – last week there were some sales of W320 from India at lower levels but this week not much activity reported. Prices are steady – around 2.65 for W240, around 2.25 for W320, around 2.15 for W450.. There were reports of sales from Vietnam at lower levels – mainly for FH 2008 shipments but some for end 2007 as well

RCN prices in Indonesia are high for early shipments but doubt whether these are sustainable with current kernel prices.. No news from Tanzania about Government / Board policy on pricing, levies, taxes - it seems crop will be normal

Brazil is expecting a good crop but this has still not resulted in any selling pressure - clearer picture should be available by mid Oct when arrivals are in full swing

In next few weeks, there might be some good demand for spot / nearby shipments but not certain whether this will translate into contracting for next year at higher levels.. Traders may decide to buy only what they absolutely need to fulfill delivery commitments and wait for dips in market to cover forward positions.

Overall demand growth seems to be steady… unless there is big jump in demand or shortage in supply (either of which could lead to change in sentiment) we expect market to stabilise around current levels with usual periodic spurts and dips

Would appreciate comments on market situation, any info on demand trends & your views on demand prospects, prices in your market and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Monday, September 10, 2007

September 8, 2007

Cashew market was quiet this week. W320 prices softened for nearby positions as some processors dropped selling ideas due to lack of buying interest. Large processors ideas continued to be around 2.70 for W240, 2.30 for W320, and 2.15 for W450. Brazil and Vietnam prices are almost the same as India and not much activity reported from these origins either

Indonesia RCN prices MOVED UP but activity is very limited. Unless RCN prices ease or kernel prices move up, we do not expect any rush from India to buy Indonesia or Vietnam RCN as processors seem to have adequate stocks in warehouses and pipeline. Since no big change is expected in kernel demand or prices, processors will be cautious in buying RCN unless there is a reasonable parity

Brazil is expecting a good crop but processors do not seem to be in hurry to make sales – probably they expect good demand from USA for next few months

It seems that kernel market is comfortable in current range (which is higher than the range we have seen since last quarter 2005 to mid 2007) and will continue to move within this range with periodic jumps and dips for specific grades and positions.. Differentials for lower grades have narrowed down to the old levels and industry seems to be adjusting to this.. Differentials for large sizes continue to be big and it does not seem that this will change in near future

Regards,

Pankaj N. Sampat

Mumbai India

Cashew market was quiet this week. W320 prices softened for nearby positions as some processors dropped selling ideas due to lack of buying interest. Large processors ideas continued to be around 2.70 for W240, 2.30 for W320, and 2.15 for W450. Brazil and Vietnam prices are almost the same as India and not much activity reported from these origins either

Indonesia RCN prices MOVED UP but activity is very limited. Unless RCN prices ease or kernel prices move up, we do not expect any rush from India to buy Indonesia or Vietnam RCN as processors seem to have adequate stocks in warehouses and pipeline. Since no big change is expected in kernel demand or prices, processors will be cautious in buying RCN unless there is a reasonable parity

Brazil is expecting a good crop but processors do not seem to be in hurry to make sales – probably they expect good demand from USA for next few months

It seems that kernel market is comfortable in current range (which is higher than the range we have seen since last quarter 2005 to mid 2007) and will continue to move within this range with periodic jumps and dips for specific grades and positions.. Differentials for lower grades have narrowed down to the old levels and industry seems to be adjusting to this.. Differentials for large sizes continue to be big and it does not seem that this will change in near future

Regards,

Pankaj N. Sampat

Mumbai India

Thursday, September 06, 2007

Looking for Gold in Them Thar Trees

Investors Rush Into Almonds,But Will They Stick AroundAs Prices Slip, Costs Rise?

By MALIA WOLLANSeptember 6, 2007; Page B1

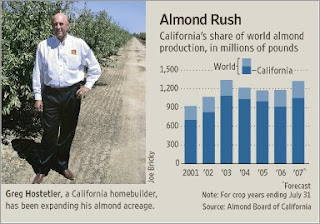

Greg Hostetler is a real-estate developer who builds subdivisions in California's Central Valley. But the past few years, he's gone nuts.

To be precise, Mr. Hostetler has been building a sideline in almonds, spending $60 million to buy and plant 4,500 acres of trees since 2000. This year, he plans to shell out at least another $5 million to plant an additional 1,000 acres.

"The almond market is looking a lot better than the housing market right now," he says.

Mr. Hostetler isn't the only newcomer jumping into California's almond game, where orchards now stretch down the Central Valley from Red Bluff in the north to Bakersfield in the south. In the past few years, doctors, lawyers, pension-fund managers and pro football Hall-of-Famers, among others, have all snapped up farmland in the state to plant almonds as world-wide demand for the nut has grown by 11% between 2001 and 2006. And despite some concerns on the horizon, many of the newer growers remain optimistic.