Weekly Cashews update

September 22, 2007

There was very little activity in cashew market this week and no change in prices. Stray trades reported W240 around 2.65, W320 around 2.25, W450 around 2.10, Splits around 1.80 FOB. Prices from Vietnam and Brazil were almost the same

Indonesia RCN being offered at high levels but no buying interest from main processors. Tanzania has not announced price, tax, policy – final meetings scheduled next week. Stakeholders hope they will fix realistic parameters so that movement is smooth and in time

Kernel buyers seem to be content to pick up quantities when reasonable offers are made… or paying up few cents for limited quantities they need to fill specific needs. There does not appear to be any interest to pay premium to build up long position

Similarly large processors are content to sell some quantities at each spurt and then wait for next selling opportunity – not keen to take any large positions unless they get a premium. Medium & small processors continue to sell when they need to (or are able to)

Product movement is steady and there is no excess inventory. This is good in the sense that entire chain is comfortable but any disruption in supply or jump in demand could queer the pitch

Overall we would expect market to move in 2.15-2.30 range unless something dramatic happens. Given the narrow margins, pricing RCN for first quarter 2008 processing and kernels for first half 2008 shipments is going to be a challenge

Regards,

Pankaj N. Sampat

Mumbai India

Monday, September 24, 2007

Monday, September 17, 2007

BY NEIL MURRAY

FOODNEWS

Friday August 31 2007

WITH just a few weeks to go before the US cranberry harvest begins, the Ocean Spray Growers Co-operative, the largest cranberry producer, has warned that supplies of raw material will be tight over the foreseeable future.

This backs up an earlier warning, at the FOODNEWS Juice Latin America conference in Sao Paulo, that a shortage was looming (FOODNEWS 18 May). The unfolding situation is being driven by a healthy escalation in sales from markets around the world, with the biggest impact from the US domestic market, as consumers increase their demand for the health benefits, taste and refreshment offered by cranberry products.

This position reflects that seen for many other fruits and nuts whose global demand is soaring, but whose supplies may sometimes fall short.

"Demand for cranberries has never been higher, driven by the growing awareness of taste and the many health benefits associated with the fruit. The success of Ocean Spray's marketing campaign in the US has created 8% base volume growth and this is being reflected elsewhere as the brand's position is being developed," said Jamie Robinson, commercial director of Ocean Spray International Services UK.

He told FOODNEWS that supply into the US market grew to 7.9 million barrels in 2006, compared with 7.2 million barrels in the previous year. US production is estimated at around 6.8 million barrels, and the rest of the supply is mostly accounted for by imports from Chile.

Fruit damage

Ocean Spray will not be drawn yet on prospects for the 2007 crop, but warns that recent hailstorms have definitely damaged the fruit."So there is only a slim chance for a large crop," warned Robinson. In addition, last year's crop was a record, and the natural crop cycle means that this year's harvest is bound to be smaller.

The rising popularity of Ocean Spray's 'craisins', sweetened dried cranberries (or SDCs), means that an increasing volume of cranberries is also being used for dried fruit production rather than juice and juice drinks.

Originally, cranberries were almost all processed into sauce and eaten by Americans on Thanksgiving Day. Now, more than 90% of the fruit is processed into juice, and in the next few years the market will be split between juice and SDCs."The demand is for craisins, and it is constraining the supply for juice," confirmed Robinson. A buyer in the UK confirmed that more fruit has been going for SDCs.

The fresh market takes about 5% of the fruit supply, and is relatively stable.

US cranberry sales in the September 2006-April 2007 period (the most recent for which figures are available) have risen to 4.4 million barrels, compared with 3.7 million barrels for the same period a year previously.

European demand in the year to April 2007 has, on the other hand, been relatively flat, but is now growing, especially in France. Again, the perceived health benefits of cranberries are responsible for this.

Ocean Spray will not be drawn on the cost of new crop cranberry concentrate. The present spot market price is around US$50/gallon, roughly equivalent to US$10 500/ tonne. Earlier this year, the spot price was nearer US$42/gallon.

"The price to manufacturers will go up; no question," warned Robinson.

He added: "Despite this shortage, we want to reassure our customers that the Ocean Spray Growers are committed to providing Ocean Spray supplied products for the UK.

We are, however, competing with other markets and customers to secure continuous supply."

© 2007 Agra Informa Ltd.The content of this web site is copyright by Agra Informa Ltd. Reproduction, retrieval, copying or transmission of the content of this site is not permitted without the publisher's prior consent.

FOODNEWS

Friday August 31 2007

WITH just a few weeks to go before the US cranberry harvest begins, the Ocean Spray Growers Co-operative, the largest cranberry producer, has warned that supplies of raw material will be tight over the foreseeable future.

This backs up an earlier warning, at the FOODNEWS Juice Latin America conference in Sao Paulo, that a shortage was looming (FOODNEWS 18 May). The unfolding situation is being driven by a healthy escalation in sales from markets around the world, with the biggest impact from the US domestic market, as consumers increase their demand for the health benefits, taste and refreshment offered by cranberry products.

This position reflects that seen for many other fruits and nuts whose global demand is soaring, but whose supplies may sometimes fall short.

"Demand for cranberries has never been higher, driven by the growing awareness of taste and the many health benefits associated with the fruit. The success of Ocean Spray's marketing campaign in the US has created 8% base volume growth and this is being reflected elsewhere as the brand's position is being developed," said Jamie Robinson, commercial director of Ocean Spray International Services UK.

He told FOODNEWS that supply into the US market grew to 7.9 million barrels in 2006, compared with 7.2 million barrels in the previous year. US production is estimated at around 6.8 million barrels, and the rest of the supply is mostly accounted for by imports from Chile.

Fruit damage

Ocean Spray will not be drawn yet on prospects for the 2007 crop, but warns that recent hailstorms have definitely damaged the fruit."So there is only a slim chance for a large crop," warned Robinson. In addition, last year's crop was a record, and the natural crop cycle means that this year's harvest is bound to be smaller.

The rising popularity of Ocean Spray's 'craisins', sweetened dried cranberries (or SDCs), means that an increasing volume of cranberries is also being used for dried fruit production rather than juice and juice drinks.

Originally, cranberries were almost all processed into sauce and eaten by Americans on Thanksgiving Day. Now, more than 90% of the fruit is processed into juice, and in the next few years the market will be split between juice and SDCs."The demand is for craisins, and it is constraining the supply for juice," confirmed Robinson. A buyer in the UK confirmed that more fruit has been going for SDCs.

The fresh market takes about 5% of the fruit supply, and is relatively stable.

US cranberry sales in the September 2006-April 2007 period (the most recent for which figures are available) have risen to 4.4 million barrels, compared with 3.7 million barrels for the same period a year previously.

European demand in the year to April 2007 has, on the other hand, been relatively flat, but is now growing, especially in France. Again, the perceived health benefits of cranberries are responsible for this.

Ocean Spray will not be drawn on the cost of new crop cranberry concentrate. The present spot market price is around US$50/gallon, roughly equivalent to US$10 500/ tonne. Earlier this year, the spot price was nearer US$42/gallon.

"The price to manufacturers will go up; no question," warned Robinson.

He added: "Despite this shortage, we want to reassure our customers that the Ocean Spray Growers are committed to providing Ocean Spray supplied products for the UK.

We are, however, competing with other markets and customers to secure continuous supply."

© 2007 Agra Informa Ltd.The content of this web site is copyright by Agra Informa Ltd. Reproduction, retrieval, copying or transmission of the content of this site is not permitted without the publisher's prior consent.

Weekly Cashew Update

Sep 15, 2007

Cashew market continued to be quiet – last week there were some sales of W320 from India at lower levels but this week not much activity reported. Prices are steady – around 2.65 for W240, around 2.25 for W320, around 2.15 for W450.. There were reports of sales from Vietnam at lower levels – mainly for FH 2008 shipments but some for end 2007 as well

RCN prices in Indonesia are high for early shipments but doubt whether these are sustainable with current kernel prices.. No news from Tanzania about Government / Board policy on pricing, levies, taxes - it seems crop will be normal

Brazil is expecting a good crop but this has still not resulted in any selling pressure - clearer picture should be available by mid Oct when arrivals are in full swing

In next few weeks, there might be some good demand for spot / nearby shipments but not certain whether this will translate into contracting for next year at higher levels.. Traders may decide to buy only what they absolutely need to fulfill delivery commitments and wait for dips in market to cover forward positions.

Overall demand growth seems to be steady… unless there is big jump in demand or shortage in supply (either of which could lead to change in sentiment) we expect market to stabilise around current levels with usual periodic spurts and dips

Would appreciate comments on market situation, any info on demand trends & your views on demand prospects, prices in your market and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Sep 15, 2007

Cashew market continued to be quiet – last week there were some sales of W320 from India at lower levels but this week not much activity reported. Prices are steady – around 2.65 for W240, around 2.25 for W320, around 2.15 for W450.. There were reports of sales from Vietnam at lower levels – mainly for FH 2008 shipments but some for end 2007 as well

RCN prices in Indonesia are high for early shipments but doubt whether these are sustainable with current kernel prices.. No news from Tanzania about Government / Board policy on pricing, levies, taxes - it seems crop will be normal

Brazil is expecting a good crop but this has still not resulted in any selling pressure - clearer picture should be available by mid Oct when arrivals are in full swing

In next few weeks, there might be some good demand for spot / nearby shipments but not certain whether this will translate into contracting for next year at higher levels.. Traders may decide to buy only what they absolutely need to fulfill delivery commitments and wait for dips in market to cover forward positions.

Overall demand growth seems to be steady… unless there is big jump in demand or shortage in supply (either of which could lead to change in sentiment) we expect market to stabilise around current levels with usual periodic spurts and dips

Would appreciate comments on market situation, any info on demand trends & your views on demand prospects, prices in your market and any other news or info

Regards,

Pankaj N. Sampat

Mumbai India

Monday, September 10, 2007

September 8, 2007

Cashew market was quiet this week. W320 prices softened for nearby positions as some processors dropped selling ideas due to lack of buying interest. Large processors ideas continued to be around 2.70 for W240, 2.30 for W320, and 2.15 for W450. Brazil and Vietnam prices are almost the same as India and not much activity reported from these origins either

Indonesia RCN prices MOVED UP but activity is very limited. Unless RCN prices ease or kernel prices move up, we do not expect any rush from India to buy Indonesia or Vietnam RCN as processors seem to have adequate stocks in warehouses and pipeline. Since no big change is expected in kernel demand or prices, processors will be cautious in buying RCN unless there is a reasonable parity

Brazil is expecting a good crop but processors do not seem to be in hurry to make sales – probably they expect good demand from USA for next few months

It seems that kernel market is comfortable in current range (which is higher than the range we have seen since last quarter 2005 to mid 2007) and will continue to move within this range with periodic jumps and dips for specific grades and positions.. Differentials for lower grades have narrowed down to the old levels and industry seems to be adjusting to this.. Differentials for large sizes continue to be big and it does not seem that this will change in near future

Regards,

Pankaj N. Sampat

Mumbai India

Cashew market was quiet this week. W320 prices softened for nearby positions as some processors dropped selling ideas due to lack of buying interest. Large processors ideas continued to be around 2.70 for W240, 2.30 for W320, and 2.15 for W450. Brazil and Vietnam prices are almost the same as India and not much activity reported from these origins either

Indonesia RCN prices MOVED UP but activity is very limited. Unless RCN prices ease or kernel prices move up, we do not expect any rush from India to buy Indonesia or Vietnam RCN as processors seem to have adequate stocks in warehouses and pipeline. Since no big change is expected in kernel demand or prices, processors will be cautious in buying RCN unless there is a reasonable parity

Brazil is expecting a good crop but processors do not seem to be in hurry to make sales – probably they expect good demand from USA for next few months

It seems that kernel market is comfortable in current range (which is higher than the range we have seen since last quarter 2005 to mid 2007) and will continue to move within this range with periodic jumps and dips for specific grades and positions.. Differentials for lower grades have narrowed down to the old levels and industry seems to be adjusting to this.. Differentials for large sizes continue to be big and it does not seem that this will change in near future

Regards,

Pankaj N. Sampat

Mumbai India

Thursday, September 06, 2007

Looking for Gold in Them Thar Trees

Investors Rush Into Almonds,But Will They Stick AroundAs Prices Slip, Costs Rise?

By MALIA WOLLANSeptember 6, 2007; Page B1

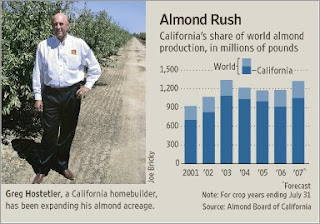

Greg Hostetler is a real-estate developer who builds subdivisions in California's Central Valley. But the past few years, he's gone nuts.

To be precise, Mr. Hostetler has been building a sideline in almonds, spending $60 million to buy and plant 4,500 acres of trees since 2000. This year, he plans to shell out at least another $5 million to plant an additional 1,000 acres.

"The almond market is looking a lot better than the housing market right now," he says.

Mr. Hostetler isn't the only newcomer jumping into California's almond game, where orchards now stretch down the Central Valley from Red Bluff in the north to Bakersfield in the south. In the past few years, doctors, lawyers, pension-fund managers and pro football Hall-of-Famers, among others, have all snapped up farmland in the state to plant almonds as world-wide demand for the nut has grown by 11% between 2001 and 2006. And despite some concerns on the horizon, many of the newer growers remain optimistic.

"Everyone knows that almonds are a great investment," says Monterey, Calif., restaurateur Dominic Mercurio, who has teamed with football commentator John Madden to purchase nearly 400 acres of almond orchards, spending more than $3 million since they bought their first 25 acres in the late 1990s. Mr. Mercurio says he and the former Oakland Raiders coach intend to buy at least another 600 acres in the next few years.

While some investors have been lured to almonds because of agricultural tax breaks, the recent rush has mainly been spurred by a boom in demand, partly fueled by high-protein diets such as Atkins and South Beach. The industry has also assiduously marketed the cousin of the peach and the plum, touting it as filling, high in antioxidants that fight colon cancer and good for the heart. The upshot: Between 2001 and 2006, the industry says, annual consumption of almonds in the U.S. grew by more than a quarter, exceeding a pound per person.

That's good news for California's agricultural sector since more than 80% of the world's almonds are grown in the state, flourishing in the Central Valley's fertile soil and a climate similar to the Mediterranean where almond trees have thrived for centuries. The nut is the state's biggest agricultural export -- ahead of wine, strawberries and cotton -- worth more than $2.7 billion a year. Overall, California has 730,000 acres of almonds now, up from 389,000 acres in 1980, according to the U.S. Department of Agriculture. The department forecasts a record 1.33-billion-pound almond crop for 2007, up 19% from 2006.

But many of the people jumping into almonds are doing so even as prices for the nut have been sliding. In 2005, farmers received $2.80 to $4 per pound of almonds. Now, about a third of the way through the almond harvest, farmers are getting $1.50 to $1.80 per pound. In a classic agricultural cycle, high crop prices resulted in a rush to plant trees, leading to a market glut of nuts. Meanwhile, almond production costs have also risen -- especially for the bees that pollinate the flowers and the diesel oil that fuels the machines that shake the nuts from the trees, sweep them from the ground and truck them to market. Recent salmonella worries have also led to new rules for pasteurizing almonds with either heat or chemicals, adding additional expenses for growers and processors.

"A lot of people are jumping on the tree-nut bandwagon," says Mike Iliff, senior appraiser for Fresno Madera Farm Credit, an agricultural lender. "They'll plant and grow and keep doing it until they drop the price down and satiate the market. You can always depend on agriculture to stab itself in the foot."

All of this has roused the ire of some longtime almond farmers, who say the newcomers are driving up land values and driving down nut prices. Second-generation farmer Stuart Woolf, who farms in Fresno and Madera County, says the ranch adjoining his 10,000 acres is up for sale at "an inflated price." The per-acre price for almond orchards in 2006 in Madera County was $8,500 to $15,000, up from $3,500 to $8,500 in 2000, according to the American Society of Farm Managers and Rural Appraisers.

Though Mr. Woolf would like to own the neighboring property himself, he says "some doctor who knows nothing about farming is likely going to buy it." That makes him worry that almonds have become more about land speculation than agriculture. He calls people like him who know the farming business and want to invest for the long haul, "patient money." These days, he says, he sees a lot of "impatient money" in almonds.

Hartley Spycher planted his first almond trees in 1960, now has 500 acres of the nuts in Turlock, Calif., and is planting 80 additional acres this year. He is less concerned about land than he is about water, worrying that as more people punch wells into the ground to irrigate their orchards, water will become scarce. Still, he says it's a free market. "If I was 18 years old, I'd be more worried," says the 70 year old.

Almonds first landed in California with Franciscan monks in the mid-1770s aboard Spanish ships bound for missions along the coast. Serious cultivation didn't begin until the 1870s, when pioneers planted hardier varieties deep in the state's interior, particularly in the Central Valley.

Since 1950, the nut has had its own marketing arm called the California Almond Board; almond farmers fund the group through a mandatory fee. In the mid-1990's, the board launched international marketing efforts to increase international sales, funded scientific research and succeeded in getting the Food and Drug Administration to certify almonds as "heart healthy." At the 2006 Oscars and other celebrity events, the board even arranged to have the nuts tucked into VIP goodie bags.

That rising profile of almonds helped attract the newcomers, including Silicon Valley developer and lawyer John Vidovich. Mr. Vidovich, who started getting into almonds in 1998, has since become one of the state's larger growers with 15,000 acres of the nuts. "The world needs more almonds," he says. "Almonds help sell other products like cereal and chocolate."

Mr. Hostetler, the Central Valley real-estate developer who is now planting more almond orchards, says his $60 million investment in the nut so far is "a little better than break even," but he'll know more after this year's harvest ends next month.

Mr. Hostetler, who still spends three-quarters of his time in the property business, says he isn't worried about the huge quantity of almonds slated to fall from the trees this season, or the thousands of acres being planted with new trees this year. When he drives his pickup truck out between the dusty rows of trees, he says he sees nothing but bounty and profit on the horizon.

"Almonds are like Las Vegas," says Mr. Hostetler, who eats almonds everyday and keeps a stash in his office. "It keeps growing, people keep thinking it's gotten too big, but still there aren't enough rooms."

Write to Malia Wollan at malia.wollan@wsj.com

RELATED ARTICLES AND BLOGS

Investors Rush Into Almonds,But Will They Stick AroundAs Prices Slip, Costs Rise?

By MALIA WOLLANSeptember 6, 2007; Page B1

Greg Hostetler is a real-estate developer who builds subdivisions in California's Central Valley. But the past few years, he's gone nuts.

To be precise, Mr. Hostetler has been building a sideline in almonds, spending $60 million to buy and plant 4,500 acres of trees since 2000. This year, he plans to shell out at least another $5 million to plant an additional 1,000 acres.

"The almond market is looking a lot better than the housing market right now," he says.

Mr. Hostetler isn't the only newcomer jumping into California's almond game, where orchards now stretch down the Central Valley from Red Bluff in the north to Bakersfield in the south. In the past few years, doctors, lawyers, pension-fund managers and pro football Hall-of-Famers, among others, have all snapped up farmland in the state to plant almonds as world-wide demand for the nut has grown by 11% between 2001 and 2006. And despite some concerns on the horizon, many of the newer growers remain optimistic.

"Everyone knows that almonds are a great investment," says Monterey, Calif., restaurateur Dominic Mercurio, who has teamed with football commentator John Madden to purchase nearly 400 acres of almond orchards, spending more than $3 million since they bought their first 25 acres in the late 1990s. Mr. Mercurio says he and the former Oakland Raiders coach intend to buy at least another 600 acres in the next few years.

While some investors have been lured to almonds because of agricultural tax breaks, the recent rush has mainly been spurred by a boom in demand, partly fueled by high-protein diets such as Atkins and South Beach. The industry has also assiduously marketed the cousin of the peach and the plum, touting it as filling, high in antioxidants that fight colon cancer and good for the heart. The upshot: Between 2001 and 2006, the industry says, annual consumption of almonds in the U.S. grew by more than a quarter, exceeding a pound per person.

That's good news for California's agricultural sector since more than 80% of the world's almonds are grown in the state, flourishing in the Central Valley's fertile soil and a climate similar to the Mediterranean where almond trees have thrived for centuries. The nut is the state's biggest agricultural export -- ahead of wine, strawberries and cotton -- worth more than $2.7 billion a year. Overall, California has 730,000 acres of almonds now, up from 389,000 acres in 1980, according to the U.S. Department of Agriculture. The department forecasts a record 1.33-billion-pound almond crop for 2007, up 19% from 2006.

But many of the people jumping into almonds are doing so even as prices for the nut have been sliding. In 2005, farmers received $2.80 to $4 per pound of almonds. Now, about a third of the way through the almond harvest, farmers are getting $1.50 to $1.80 per pound. In a classic agricultural cycle, high crop prices resulted in a rush to plant trees, leading to a market glut of nuts. Meanwhile, almond production costs have also risen -- especially for the bees that pollinate the flowers and the diesel oil that fuels the machines that shake the nuts from the trees, sweep them from the ground and truck them to market. Recent salmonella worries have also led to new rules for pasteurizing almonds with either heat or chemicals, adding additional expenses for growers and processors.

"A lot of people are jumping on the tree-nut bandwagon," says Mike Iliff, senior appraiser for Fresno Madera Farm Credit, an agricultural lender. "They'll plant and grow and keep doing it until they drop the price down and satiate the market. You can always depend on agriculture to stab itself in the foot."

All of this has roused the ire of some longtime almond farmers, who say the newcomers are driving up land values and driving down nut prices. Second-generation farmer Stuart Woolf, who farms in Fresno and Madera County, says the ranch adjoining his 10,000 acres is up for sale at "an inflated price." The per-acre price for almond orchards in 2006 in Madera County was $8,500 to $15,000, up from $3,500 to $8,500 in 2000, according to the American Society of Farm Managers and Rural Appraisers.

Though Mr. Woolf would like to own the neighboring property himself, he says "some doctor who knows nothing about farming is likely going to buy it." That makes him worry that almonds have become more about land speculation than agriculture. He calls people like him who know the farming business and want to invest for the long haul, "patient money." These days, he says, he sees a lot of "impatient money" in almonds.

Hartley Spycher planted his first almond trees in 1960, now has 500 acres of the nuts in Turlock, Calif., and is planting 80 additional acres this year. He is less concerned about land than he is about water, worrying that as more people punch wells into the ground to irrigate their orchards, water will become scarce. Still, he says it's a free market. "If I was 18 years old, I'd be more worried," says the 70 year old.

Almonds first landed in California with Franciscan monks in the mid-1770s aboard Spanish ships bound for missions along the coast. Serious cultivation didn't begin until the 1870s, when pioneers planted hardier varieties deep in the state's interior, particularly in the Central Valley.

Since 1950, the nut has had its own marketing arm called the California Almond Board; almond farmers fund the group through a mandatory fee. In the mid-1990's, the board launched international marketing efforts to increase international sales, funded scientific research and succeeded in getting the Food and Drug Administration to certify almonds as "heart healthy." At the 2006 Oscars and other celebrity events, the board even arranged to have the nuts tucked into VIP goodie bags.

That rising profile of almonds helped attract the newcomers, including Silicon Valley developer and lawyer John Vidovich. Mr. Vidovich, who started getting into almonds in 1998, has since become one of the state's larger growers with 15,000 acres of the nuts. "The world needs more almonds," he says. "Almonds help sell other products like cereal and chocolate."

Mr. Hostetler, the Central Valley real-estate developer who is now planting more almond orchards, says his $60 million investment in the nut so far is "a little better than break even," but he'll know more after this year's harvest ends next month.

Mr. Hostetler, who still spends three-quarters of his time in the property business, says he isn't worried about the huge quantity of almonds slated to fall from the trees this season, or the thousands of acres being planted with new trees this year. When he drives his pickup truck out between the dusty rows of trees, he says he sees nothing but bounty and profit on the horizon.

"Almonds are like Las Vegas," says Mr. Hostetler, who eats almonds everyday and keeps a stash in his office. "It keeps growing, people keep thinking it's gotten too big, but still there aren't enough rooms."

Write to Malia Wollan at malia.wollan@wsj.com

RELATED ARTICLES AND BLOGS

Monday, September 03, 2007

Weekly Cashews Update

September 1, 2007

Cashew market continued to be quiet with no perceptible change in prices. Levels were 240 around 2.70, 320 around 2.25, 450 around 2.15, SW around 2.10 FOB. Not much business as small packers do not have much to offer and large packers looking for few cents more

As expected, early prices for Indonesia RCN are high but unless kernel market continues to be firm in Sep, processors will not been keen to buy at these levels. Tanzania crop is expected to be good but it is to be seen what Government decides about pricing guidance, taxation, financing to local industry.

Brazil is expecting a good crop but opening prices might be high as processors do not have stock and current kernel prices are higher than last year (however the stronger currency might cap the RCN prices in local currency). If RCN prices stabilise at reasonable levels, USA might be able to cover first quarter needs from Brazil and this would cap the rise in kernel prices

In the next 8-10 weeks, fair amount of contracting will be done in Europe for next year deliveries (in last couple of years we have noticed slight shift – buying has been more spread out, either due to change in buying pattern or because the market has been moving in a narrow range). This time, pricing might be difficult as we are looking at a new, higher range after a long period of trading in the 1.90-2.10 range. The stronger Euro/GBP makes life little easier for buyers in Europe (which is the second biggest cashew importing region)

Overall, feeling is that unless there is a big surge in demand, we will see market stabilizing around current levels – downside is limited

Regards,

Pankaj N. Sampat

Mumbai India

September 1, 2007

Cashew market continued to be quiet with no perceptible change in prices. Levels were 240 around 2.70, 320 around 2.25, 450 around 2.15, SW around 2.10 FOB. Not much business as small packers do not have much to offer and large packers looking for few cents more

As expected, early prices for Indonesia RCN are high but unless kernel market continues to be firm in Sep, processors will not been keen to buy at these levels. Tanzania crop is expected to be good but it is to be seen what Government decides about pricing guidance, taxation, financing to local industry.

Brazil is expecting a good crop but opening prices might be high as processors do not have stock and current kernel prices are higher than last year (however the stronger currency might cap the RCN prices in local currency). If RCN prices stabilise at reasonable levels, USA might be able to cover first quarter needs from Brazil and this would cap the rise in kernel prices

In the next 8-10 weeks, fair amount of contracting will be done in Europe for next year deliveries (in last couple of years we have noticed slight shift – buying has been more spread out, either due to change in buying pattern or because the market has been moving in a narrow range). This time, pricing might be difficult as we are looking at a new, higher range after a long period of trading in the 1.90-2.10 range. The stronger Euro/GBP makes life little easier for buyers in Europe (which is the second biggest cashew importing region)

Overall, feeling is that unless there is a big surge in demand, we will see market stabilizing around current levels – downside is limited

Regards,

Pankaj N. Sampat

Mumbai India

Subscribe to:

Posts (Atom)